Applying AI to facilitate and secure the growth of our clients’ financial assets

TRAIDY is a fully automated AI-powered algorithmic trading strategy. TRAIDY trades equities (stocks and ETFs). It can be applied to any stock market index (S&P 500, STOXX50, NIKKE225, FTSE100).

Built on sophisticated trend analysis, TRAIDY identifies trend reversals in stocks, executing trades with precision on behalf of its users. It leverages proprietary indicators to uncover hidden patterns in historical price movements, enabling it to anticipate the end of a downtrend and the emergence of a new uptrend for each stock/ETF separately.

Performance of TRAIDY

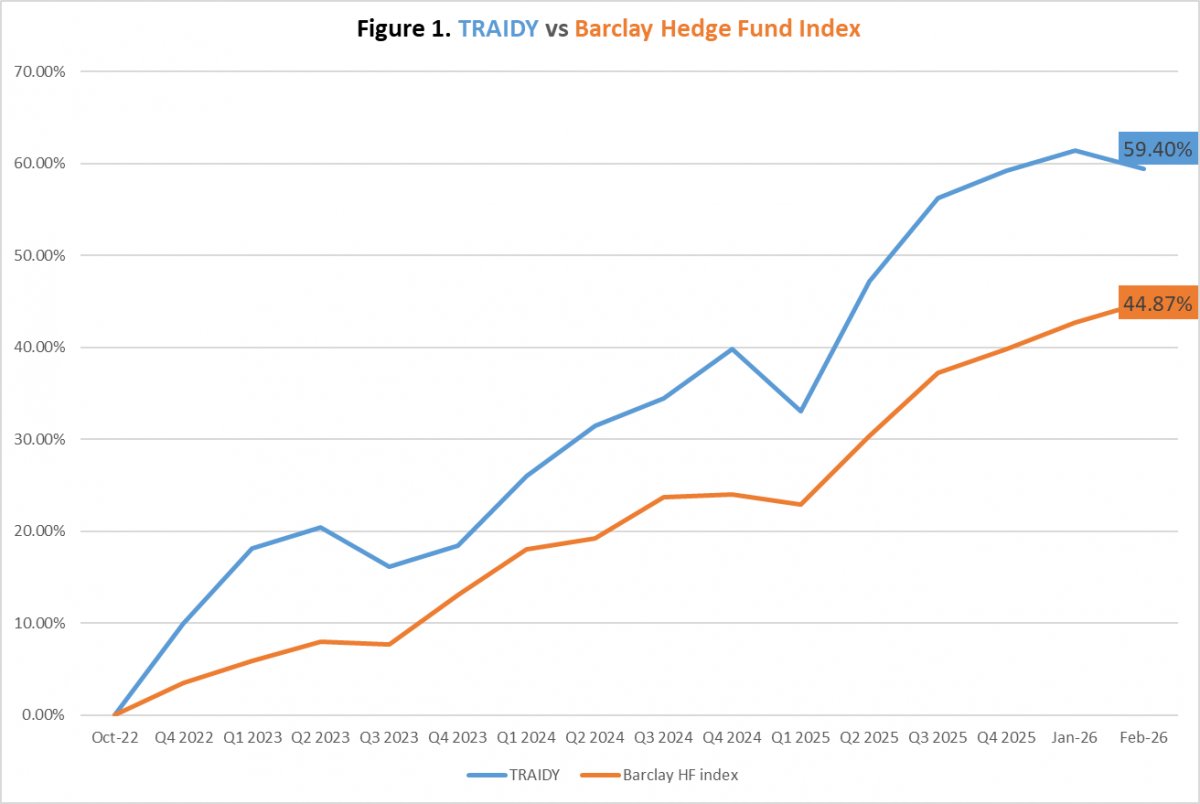

Figure 1 below depicts the cumulative returns generated by the progressive version of TRAIDY (for more details, please see below) and those generated by the Barclay Hedge Fund index. This demonstrates that TRAIDY has outperformed many other hedge funds (in terms of returns) over the last three years.

Adjusting Risk with TRAIDY

TRAIDY’s dynamic risk management adapts in real-time, utilizing self-adjusting profit and stop-loss thresholds tailored to each stock’s unique price behaviour. This ensures an intelligent and adaptive trading approach, maximizing profitability while mitigating risk. Moreover, TRAIDY maintains an excellent balance of equity vs cash and a balanced portfolio across all sectors. With state-of-the-art money management and position management modules, TRAIDY provides even more solid risk management.

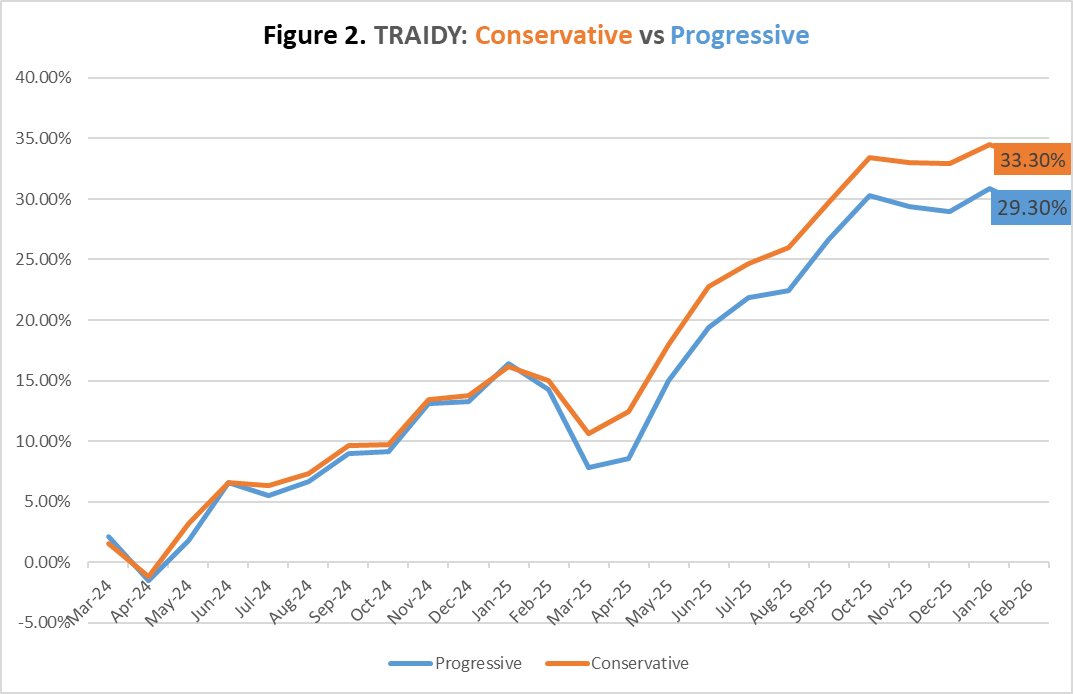

TRAIDY allows users to set their risk tolerance preferences. TRAIDY’s risk tolerance settings can range from 0 (almost risk-free) to 100 (maximum risk). Based on the risk choice the user has made, TRAIDY will analyze the situation and the market conditions to provide the best performance under these conditions. In order to show how TRAIDY performs under different risk levels, FINAID established two versions of TRAIDY, a ‘progressive’ and a ’conservative’ one.

Figure 2 (TRAIDY: Progressive vs Conservative) provides a comparison between the cumulative results generated by the two versions since March 2024. The situation during the first half of 2025 provides an environment favourabale to the conservative version. This figure also shows that TRAIDY’s risk management is effective.

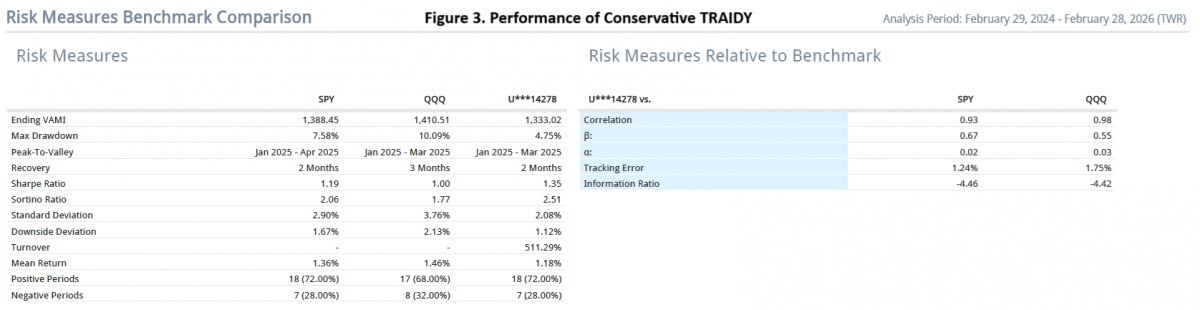

Figure 3 reports major performance metrics of the conversative version of TRAIDY since its inception in March 2024. This version provides, compared to the market, very good Sharpe and Sortino ratios, and is generating positive Alpha. Moreover, it maintains an attractive level of risk (measured in terms of Max drawdown and Downside deviation).

Please note the following with regards to the two versions of TRAIDY:

- Each portfolio is managed by a totally independent instance of TRAIDY

- The portfolio managed by Conservative TRAIDY was established in March 2024.

- The portfolio managed by Progressive TRAIDY was established in October 2022.

- The risk tolerances associated with Conservative and Progressive TRAIDY are 40% and 65%, respectively.

Investing in TRAIDY

TRAIDY has been included in Maverix' Actively Managed Certificates (AMC), allowing for secured investments - all details of this investment are included in the related Termsheet.pdf To participate in TRAIDY's success by investing, just use this term sheet to place investments.

Furthermore, it is planned to include TRAIDY in the new UAE trading platform Coinquant in Q2 of 2026 - keep watching this space.

TRAIDY has been included in Maverix' Actively Managed Certificates (AMC), allowing for secured investments - all details of this investment are included in the related Termsheet.pdf To participate in TRAIDY's success by investing, just use this term sheet to place investments.

Furthermore, it is planned to include TRAIDY in the new UAE trading platform Coinquant in Q2 of 2026 - keep watching this space.